2022 is turning out to be a tough year. Many people thought that as we emerged from Covid lockdowns that life would get easier as things got back to normal. But that’s not where we find ourselves as we are hit by a new set of challenges.

The Bank of England issued a warning on Thursday, stating that the current recession in the United Kingdom is the country’s longest ever. Due to the surging energy prices and toughened financial conditions impacting spending, growth is predicted to continue to decline during 2023 and even into 2024.

The Bank noted that during this time, unemployment is expected to double to 6.5% and characterised the outlook for Britain’s economy as “extremely problematic.” According to the Bank, the UK’s GDP is expected to have shrunk by roughly 0.75% in the second half of 2022, representing the strain on households brought on by rising energy prices and costs of goods. Life is set to become even harder.

How did this happen? Why for many people will this be another difficult Christmas, for reasons very different from the social isolation we faced for the last two years?

A key factor in the current economic conditions is the rapid increase of inflation. A good economy is facilitated by low and consistent inflation. To achieve this, the UK government sets a goal for the percentage that prices should increase by, overall, each year.

The target is 2% and the Bank of England is responsible for maintaining inflation at that level. When inflation is too high, or unsteady it can be damaging. People find it challenging to work out whether to spend or save when prices rise in unprecedented ways. In extreme circumstances, excessive and unstable inflation can bring about rapid economic decline.

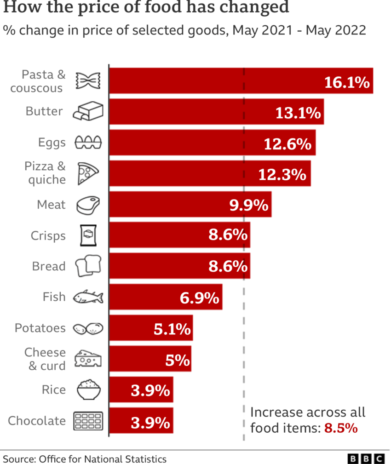

Currently, with inflation at 10.1%. The impact on household across the U.K have resulted in a ‘cost of living crisis’ where stagnant wages and benefits have exacerbated the effects of inflation on real incomes. People who have not struggled before are finding they can’t pay their bills or afford food. People in full time work, like nurses, civil servants and teachers, are having to turn to food banks to survive.

The effects of inflation on everyday items has had the most profound impact on lower-income families. The Independent Food Aid Network reported that 93% of food banks* reported an increased use of their services since the start of 2022, with 95% of these citing the main reason as being the rise in cost of living over the past year. The increased prices of heat have left some families with no choice but to turn to charity aid for support, as government payments have been a long and complicated procedure for many and often not enough.

A campaign set up by a group of UK charities ‘Warm Welcome’ to set up heated spaces in work with local councils, where anyone can go to avoid the soaring charges of turning on their own heating. The campaign director David Barclay stated, ‘We believe that a movement in the country is stirring… which can help us, as a country, change direction on poverty.’ There have been devastating effects on the increased overhead costs of businesses in local communities; the same businesses that the government spent billions supporting during Covid.

One of the biggest strains on families in the U.K. recently has been the rise in gas and electricity bills. The UK still uses gas to generate energy and heat homes, resulting in us being exposed to fluctuations in gas prices and although the UK doesn’t directly import much Russian gas, a decline in supply worldwide – Russia is the second-largest gas producer – has had a pronounced influence on the global gas markets that affect the UK.

Due to the situation in Ukraine, expenses in the UK and elsewhere have increased significantly, reaching an increase of more than 100% in price since April 2022. Inflation has increased globally as a result of supply chain disruptions that have driven up costs. Households are now paying for these global events.

The weeks (or months) of political turmoil the country experienced were another series of events that plunged the UK economy into crisis. In particular, the election of MP Liz Truss to the position of Prime Minister following her victory in the Conservative Party leadership contest on the strength of her pledge to create a high-growth, low-tax economy. The British financial markets were in chaos for weeks following the announcement of the proposed “mini budget” by then-chancellor Kwasi Kwarteng, which also featured a reduction of corporate tax rises and a delay on scheduled cost increases for national insurance.

In addition to a worsening issue with cost of living, Truss’s proposal drove away overseas investors from the British economy, causing the value of the pound versus the dollar to reach historic lows.

Since then, the new Prime Minister, Rishi Sunak, and Chancellor Jeremy Hunt have released their own new budget, which focuses on raising taxes and tightening spending by the government. This includes benefits and the contribution by government to individual’s energy bills, which is also to be reconsidered.

But with the country currently experiencing wide ranging strikes and further threats of strikes on the horizon, does it seem like people feel enough is being done to prevent they and their families from being plunged into poverty?

To combat the fact of inflation, the Bank of England raised interest rates significantly. Interest rates are presently around 3% – the highest since 2008 – and this hike will have substantial impact on the homeowners in the United Kingdom as mortgage rates climb.

Also, the government has set in place a package that comprises of one-time payments to pensioners, those who are in receipt of benefits and those with disabilities. These payments are designed to help individuals cope with the rising cost of living.

However, many believe that these measures are not enough. A poll carried out by The Independent in August 2022 shows that more two-thirds of individuals believe that government intervention to help with the cost of living crisis has not been for sufficient.

With winter approaching and more homes using more gas and electricity, many fear that the problem will worsen. Low income households and the vulnerable in society are likely to be most affected.

At the moment, it doesn’t feel like people think the government has the answers to rescue us from an economic crisis that was partially of their own making. Let’s wait and see what 2023 brings.

If you have any stories, views or solutions regarding this issue, let us know. We would love to hear from you.

By Naima Aden