I’m sure you’ve heard talk about ‘ the cost of living’ or ‘high levels of inflation’ at least once in the last month or so, be that by your parents, classmates at school or on the evening news, but do you know what this actually means and how it will affect us all in the next few months? In this article, we will discuss what the cost of living crisis is, how it will most likely affect our daily lives and ways in which the government is trying to tackle the problem.

What is the cost of living crisis?

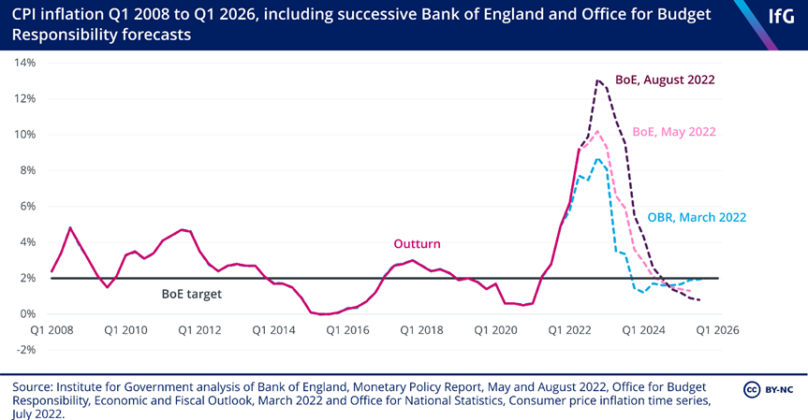

For one, the ‘cost of living crisis’ is directly impacted by high levels of inflation that surged rapidly in 2021, following the ease of Covid restrictions and the reopening of many businesses in the UK and across the globe. Inflation is the average rate at which prices of product and services rises in an economy. The higher the inflation, the higher the prices, which limits the value of our money. In layman’s terms, this means that a loaf of bread that might have cost £1 in 2020, might cost around £1.30 by the end of 2022. Whilst these changes in prices are less intimidating on their own, the combination of many household product prices increasing and wages staying around the same, means that there is panic over whether homes will be able to sustain satisfactory standards of living. Inflation is currently at around 9%, which is a whopping 11% more than the previous year (-2%). Whilst these figures may seem quite unimpressive, if we look at the effects even a one percent increase can have on the economy, the true implications of this rise can be fully realised.

What factors are contributing to the current levels of inflation?

Whilst Covid was a significant factor in increasing levels of inflation, other factors such as recent disruptions to global supply chains and the Russian invasion of Ukraine, have created an unstable economy where the laws of supply and demand are being flouted constantly. The fact that most incomes are staying the same, or only increasing directly with inflation, means that people are actually paying more for less. Brexit is also having a long-term cause on the upsurge in costs of living, as we now pay more to be able to trade products with members of the EU.

What impacts will the cost of living crisis have on us as individuals?

Effects of the rise in inflation are already beginning to show, with rents rising fast and fuel prices reaching excessive heights, with the price of filling a car’s fuel tank costing more than ever before . More and more people are relying on savings to meet day to day bills, and budgeting is now becoming crucial for people to be able to live normal lives. You may find yourself shopping less for clothes and electronics and possibly switching products from well-known brands to more price friendly alternatives, like the supermarket own brands.

Will the cost of living crisis cease?

Whilst headlines may spark panic and urgency, with bold letters portraying the current crisis as the end of the UK’s economy as we know it, it is likely that the current levels of inflation will begin to slow down over the course of 2023. Inflation can be seen as a sign of a healthy economy, and whilst the current levels seem to be quite alarming, budgeting correctly and saving wisely is the best way we can go forward until inflation begins to drop or level. It does mean that you may have to limit splurges and treats to maybe two or three times a month instead of every week, but ultimately, you can rest assured that the UK is expected to bounce back from this crisis. In the meantime, it is important that we do our best to help the more vulnerable people within our society, such as the old and the weak and ensure that the people around us are well.

By Rukaiyya Anas