THE SIN TAX

The sin tax is a tax placed usually on junk food products, designed to eventually dissuade the public from buying them. Or, on the other hand, the tax is designed to raise funds from the purchases of these ‘unhealthy’ foods – a positive outcome from a negative act.

Lately, countries all over the world debate on whether implementing a sin tax would result in societal improvement, or its degradation…

There are numerous biological, spiritual, and chemical definitions for what ‘healthy’ means, but the term ‘unhealthy’ in this world becomes more subjective everyday.

Although the label ‘unhealthy’ can easily be placed on items scientifically proven to be detrimental to health (like tobacco or alcohol), the goods we use leisurely in day-to-day life are harder to categorise. Therefore, if a product cannot be absolutely defined as unhealthy, is it even logical to tax them?

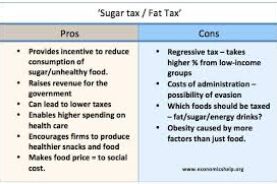

There is some ambiguity regarding what is or isn’t healthy in the food industry, so consumers’ differing viewpoints can cause some uproar. This outrage could stem from the implementation of a sumptuary tax, designed to stymie overconsumption of items considered to be socially harmful, called a sin tax. If it were to be levied on products that aren’t universally recognised as unhealthy, a government would struggle to find justification that would satisfy the public, seemingly imposing a totalitarian regime. With a tax that people may protest, market mechanisms would be negatively distorted due to this price control, and the economy may run less smoothly.

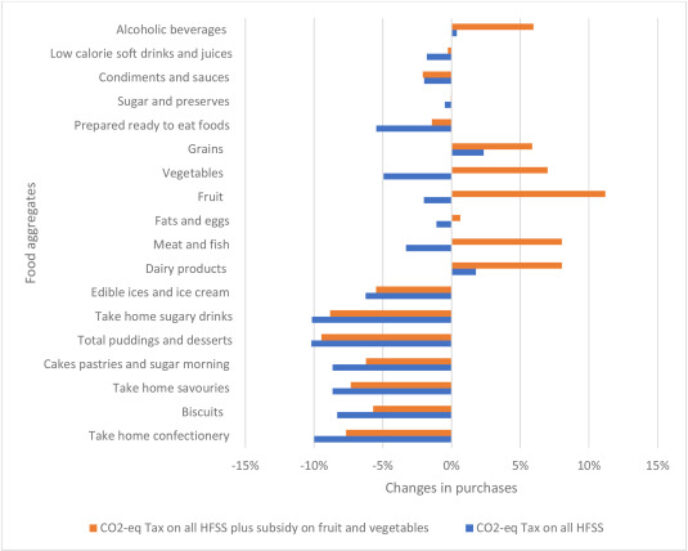

Moreover, the sin tax has recently become more in line with governmental aims: of improving their local economies, and the welfare of those it revolves around. One would assume that this tax would lead to a massive societal improvement. This would be partially correct, for instance on a public health aspect. If the sin tax arose, the public would naturally be dissuaded from indulging in unhealthy goods, leading to decreased development of diseases and conditions caused by poor lifestyle choices (Health Affairs, 2022). Less stress would be placed on healthcare services, that the government could then sufficiently fund based on supporting the conditions in need of attention. Next, it could theoretically encourage positive action in communities, with less slovenliness and a weakened atmosphere of danger once cultivated from those excessively smoking or drinking.

However, these advantages come with drawbacks. In a growing world with growing consumption rates, certain economies completely depend on the supply and demand of such ‘unhealthy’ goods. Encompassing low/middle-income countries, industries like tobacco employ approximately 60 million people globally.

Take the country of Malawi, generating its major sources of revenue from large exports of tobacco, possessing a tobacco-dependent economy. In rural areas, the industry acts as a strong infrastructure to the lives of many, supporting the incomes of the local people. And without the intact livelihood of the people, the economy cannot function. But tobacco is bad for our health, and so a question of ethics comes into concern: for the sake of the public’s health, should the employment of millions be threatened?

Another problem attached to the sin tax is how it affects others differently because of income inequality. Taxes can be discriminatory to those who suffer financially, who can’t even enjoy luxuries and commodities because of their increased prices.

The IEA (Institute of Economic Affair) comments on the effects of a sin tax in one of their 2018 reports. Commenting on the report, author Chris Snowdon said:

This comment argues that a single tax on food in the UK would harm low-income households, as they heavily rely on affordable food options. It would also exacerbate the UK’s growing food poverty predicament, in which millions of people are pushed below the breadline, already struggling to feed themselves. (Food poverty in the UK, big issue.com). Currently, rising food costs have already led to a record food bank usage, with essentials like bread and milk becoming increasingly unaffordable.

Some food systems are even more fragile, harder to simply place a tax. Take into consideration the American food system: notorious for its food insecurity and highly processed foods. The result of this was the prevalence of obesity being approximately 42.4% among adults in 2017-2018(CDC, 2020), being indicative of how malnourishing the average American diet is.

Despite this, not much has been done to tackle this public health issue. Why? Because these high-fat, high-sugar, artificially flavoured products are the only things within the price range of the lower-income individuals who rely on inexpensive, calorie dense foods for survival. In the grand scheme of the average person’s life, feeding the mouths of their families is prioritised over the mere speculation of better health.

Ultimately, a government who introduces a sin tax would hope to profit from it, if successful. But if it succeeded, people would completely avoid all unhealthy goods with the tax, so how could the government profit from items that nobody buys? In terms of gain, it would be equivalent to adding houses to your Monopoly property – that nobody lands on. On a broader scale, this tax would promote better public health, but the government wouldn’t be able to fulfil their hopes of distributing what they earned from the taxes towards funding public services like education.

Personally, I think a sin tax would be difficult to implement and would inadvertently cause socioeconomic issues – which is what a government should avoid. These issues would disrupt a fundamental in our society: that a functioning economy depends on the livelihood of its citizens, and vice-versa.

By Astrid King